It has been an ugly period for various Cryptocurrencies. If you haven’t heard, the collapse of Sam Bankman-Fried's FTX crypto empire was recently revealed to be a house of cards. The fallout from what has been described as one of the most serious to hit the blockchain industry has quickly led to Cryptocurrencies suffering what can only be described as a “contagion effect.”

What does that mean? Well, not only are we wary of FTX, but the well-known cryptocurrency, BitCoin took a fall too. And the world's second most popular cryptocurrency, Ethereum also tanked. It’s also a stark reminder that investing in cryptocurrencies comes with significant risk. Not only are you relying on the market activity and worrying about losing your passphrase, but now there are these cryptocriminals on a rampage.

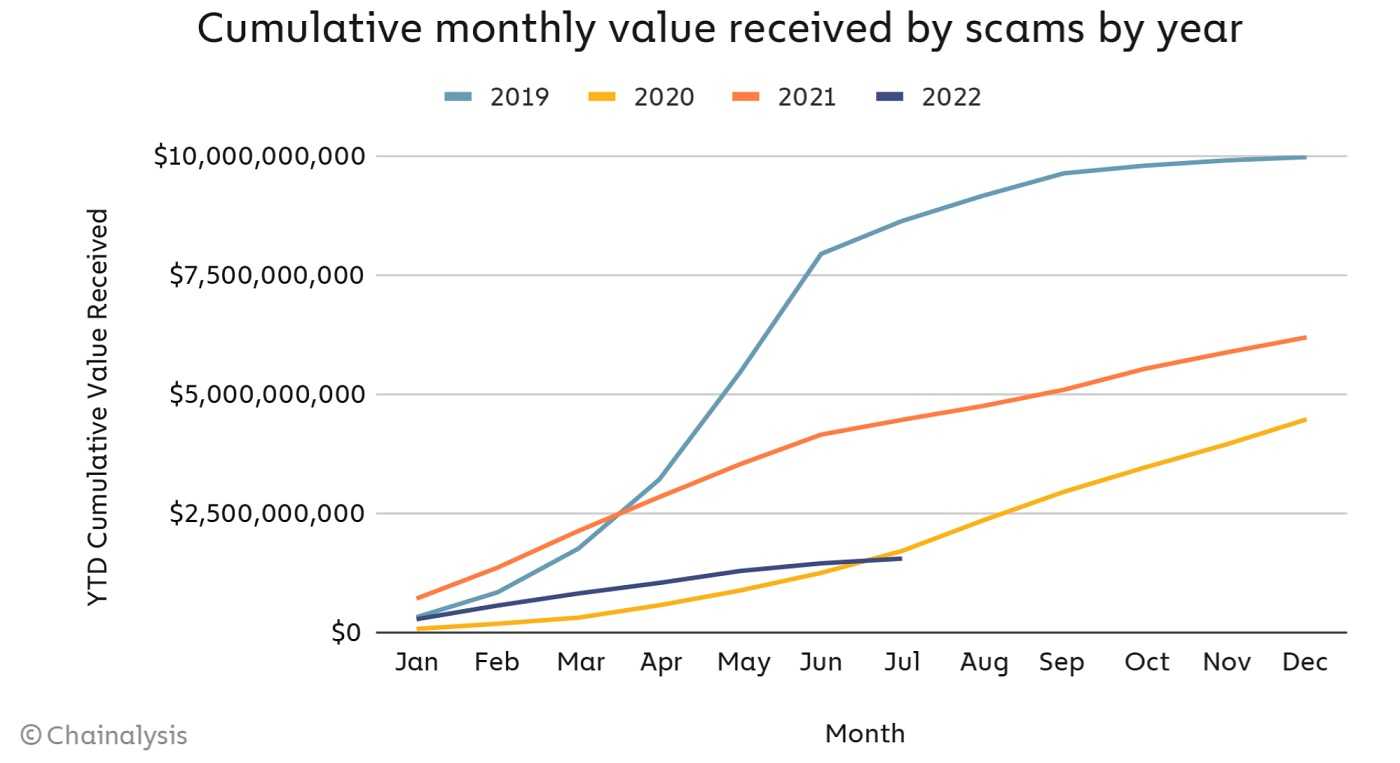

To make matters worse, attackers have kicked up the volume in engaging in widespread theft of cryptocurrencies, particularly at the end of the past year; topping 2021 numbers. In total, figures from the third quarter of 2022 show a 28% increase in blockchain incidents when compared to the same timeframe in 2021.

The total loss caused by Cybercriminals (Blockchain hackers) for the first three quarters of 2022 was $2,570,117,825. Yes, that’s billion with a “B.”

Bitcoin might be suffering, but other Crypto Exchanges led the pack when it came to losses caused by hackers. The biggest loser was the Ethereum (ETH) ecosystem which saw losses of $348 million caused by 11 major attacks. Polkadot was a distant second with losses totaling $52 million, however, it is noteworthy that this loss was caused by only two attacks. The third place on the loser's podium is occupied by Binance Smart Chain (BSC). It was hacked 13 times and saw $28 million in cryptocurrency disappear.

NFT's have also not been immune from hacking attacks. Those are “non-fungible tokens) and are considered the digital world’s answer to collectibles. Those saw $4 million lost to cyber criminals during seven events.

So, if you’re going to try your hand at either of these digital assets, experts advise avoiding custodial wallets (these digital wallets allow investors to manage the keys needed to handle Blockchain digital assets). Custodial wallets are the default storage option held and operated by exchanges and are usually stored on a connected device, allowing them to be stolen. It’s better to use “cold wallets.” These are offline hardware wallets in the form of an external storage device (like a memory stick) that are not connected to the internet, unlike the 'hot' or custodial wallets.

But as with the abundance of passwords we all need to remember, a good old piece of paper and pen work just fine too. Make sure to lock it away, out of sight, when not in use. And remember that losing a password or key for digital currency is forever. Those cannot be retrieved by clicking “forgot password.”