Finding Payment Card Fraud and What to Do About It

April 19, 2025

We all dread the thought of finding payment card charges we don’t recognize. We have to wonder if someone, somewhere breached our account and went on a shopping spree. If you’d like to know what to do about a suspected fraudulent charge and how to go about filing a credit fraud claim, this is for you.

First, it’s important to remember we’re human, and we might forget making a payment card purchase—like ordering something online or buying lunch. And with the many subscription services out there, some could be recurring charges we don’t recognize right away. Also, don’t forget someone else who may be authorized to use your card. So, put on your thinking cap first and try to remember what you may have forgotten. After that, you can try the next tips.

Deciphering Charges

Deciphering the way some charges appear on a statement takes a little detective work. Abbreviations and other mysterious clues need translating for more information. For help, copy the full description into a search bar. There you’ll see if someone else investigated a similar charge or identified the name of the business or payment processor. There are also payment card purchase databases that are crowd-sourced for more information. If needed, calling your card-issuer could offer translation help.

Filing A Claim

After trying the above options you’re convinced a charge is fraudulent, call your card provider using the number on back of the card to start the claims process. Your card gets cancelled immediately and they issue you a new one. Thanks to the Fair Credit Billing Act, you won’t be responsible for more than $50 of the fraudulent purchase, if you catch it right away. Keep in mind that “fraudulent purchases” are different “authorized fraudulent purchases.” If you are convinced you put something on your card that turns out to be fraud, it might be more difficult to get the charges removed. So, you also have to follow the anti-phishing tips we discuss all the time:

- If you’re not expecting a link or attachment, don’t click it.

- If you don’t know the sender, or aren’t sure about it, don’t click.

- Never provide your payment information to someone who contacts you unsolicited. If you don’t initiate the call, it’s best not to give it out.

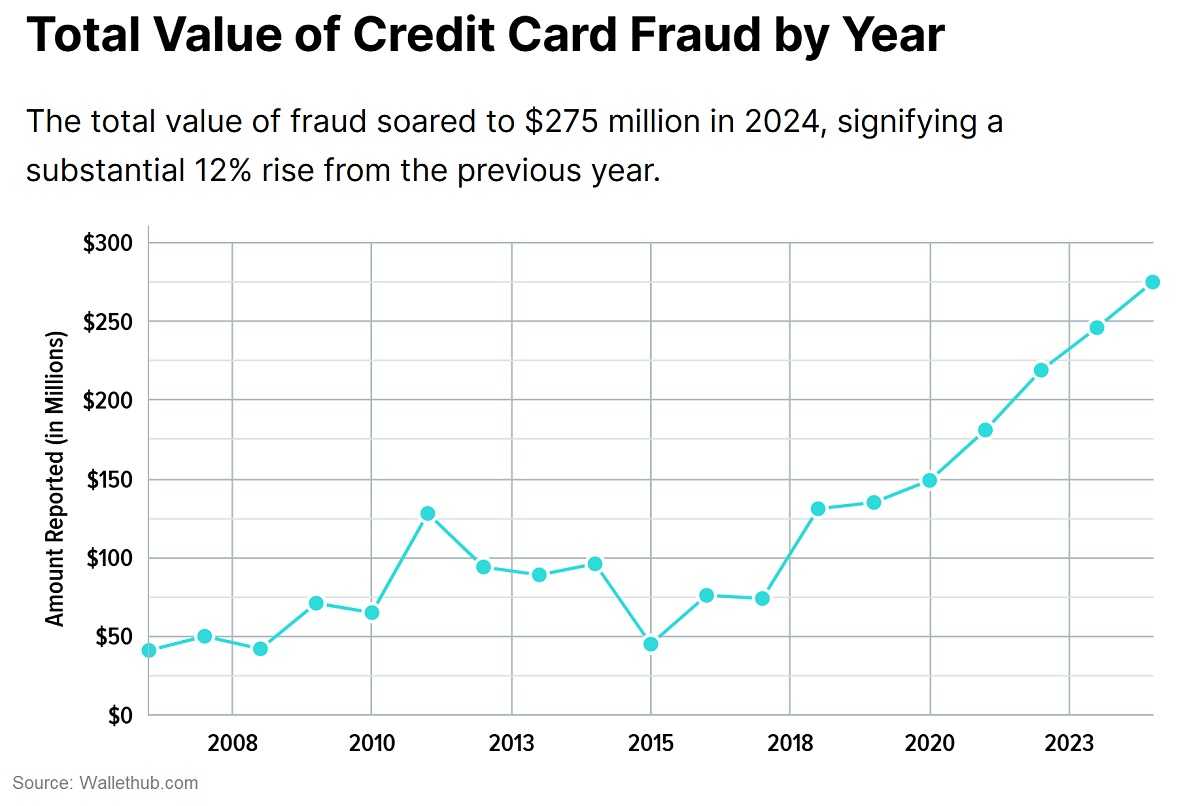

The world of payment card fraud today is full of cybercriminals, hackers, skimmers, and shimmers—and they’re all trying to help themselves to our hard-earned credit. Take a look at your charges often and report anything that’s off right away. It’ll save you money and a lot of headaches.