Online scammers are always in hot pursuit of new ways to separate us from our money, and this year is no different. Taking a look at some of the top scams trending this year can help us avoid becoming the next cybercrime statistic, so read on.

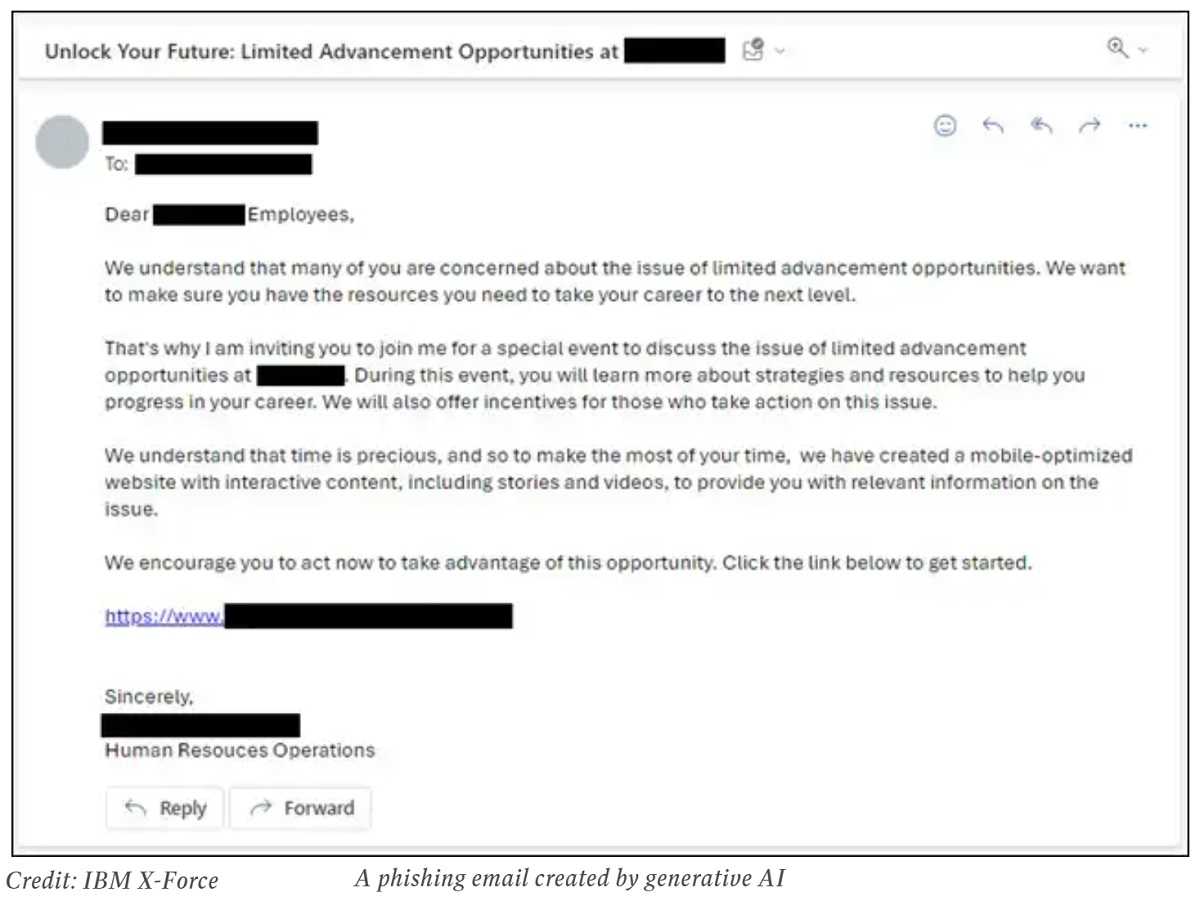

AI-Fueled Scams

Advancements in this technology gives scammers new ways to fool our eyes and ears. AI-generated email and text phishing is more persuasive than ever before. The same goes for deepfakes impersonating a celebrity with a hot investment tip or a family member desperately needing our help.

CyberSTAT: A 1,265% increase in phishing emails in the first 12 months following the launch of ChatGPT, the AI-enabled language model.

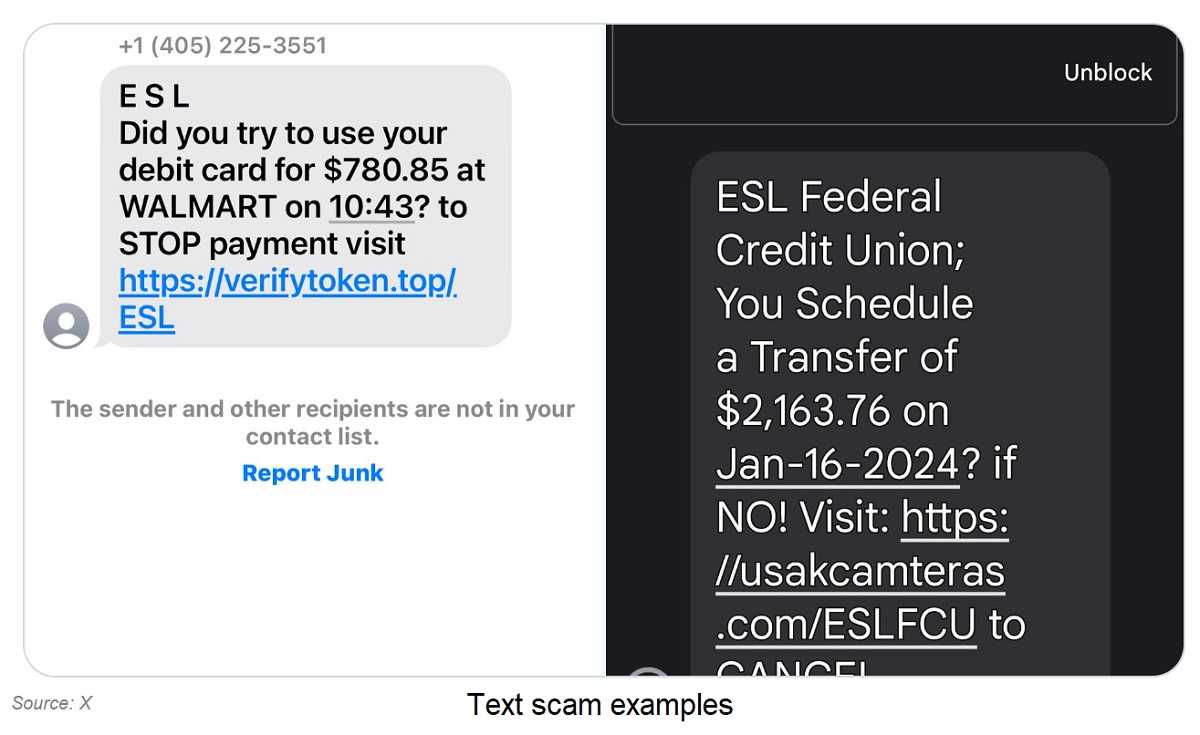

Smartphone And Text Scams

Phone scams (vishing) include robocalls, impersonating the IRS, or a delivery service are all designed to steal your PII and more. They’ll even use threats and other scare tactics to get what they’re after. Getting you to scan a malicious QR code or download a malware-filled app or stealing your one-time password (OTP) are also typical ploys.

Text scams (smishing) use similar impersonation tactics to shake-out your PII. The text messages vary, but the goal is having you call a number or follow a link. The person answering your call is a scammer, and the link takes you to a bogus web page that steals information or installs malware.

CyberSTAT: In 2022, text scams alone cost Americans more than $330 million.

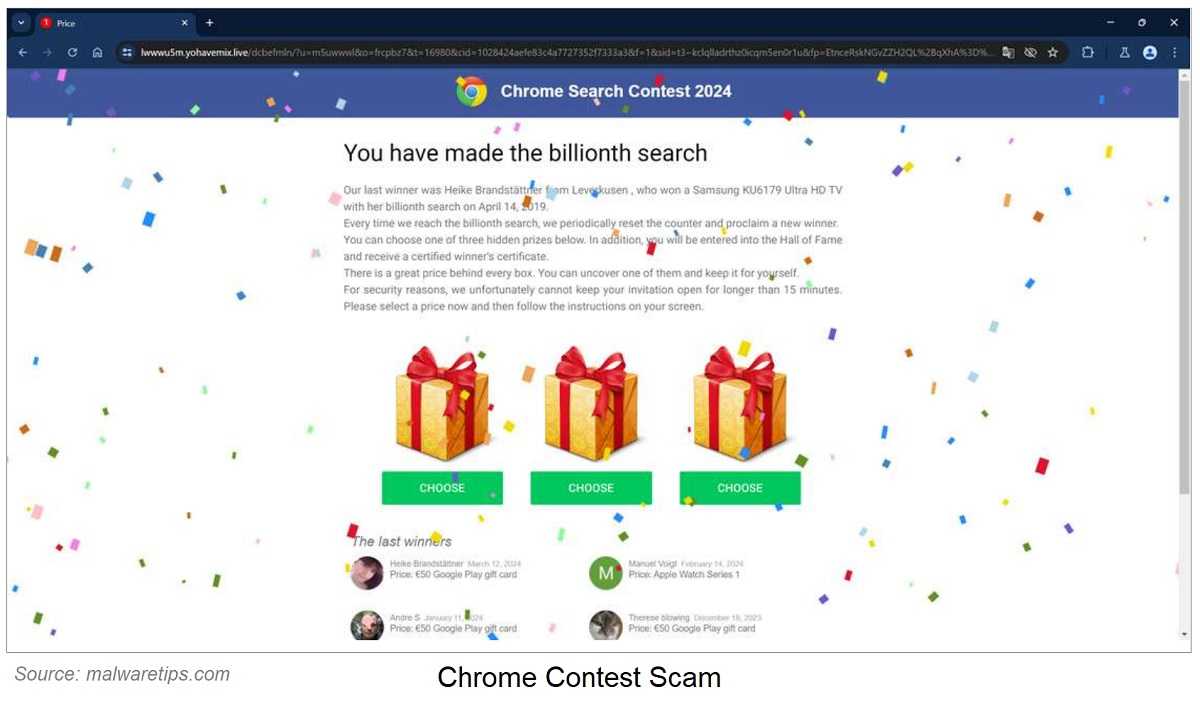

Financial Scams

These scams go directly after your money. They use impersonation, intimidation, being a contest winner, and any other way to steal your PII and cash money. Some of the more popular scams involve peer-to-peer payment apps like Zelle or PayPal, cryptocurrency investments, check fraud, online shopping scams, student loans, and even romance scams.

CyberSTAT: In 2023, Americans lost more than $4.6 billion to investment scams.

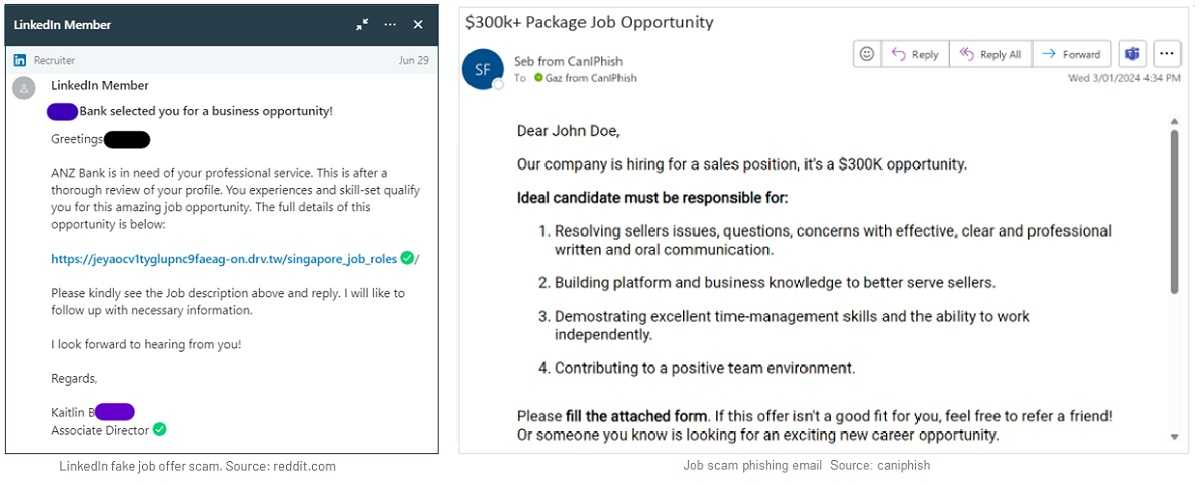

Employment Scams

Scammers are happy to help you land that well-paying job at your expense. Looking legitimate is what these scams are about, and they use a range of lures to grab your Social Security number, driver’s license, and financial info. From there, all kinds of identity theft are possible. So, beware of a job offer requiring a lot of documentation, requires you pay for equipment or training, or do work for payment that never arrives. They’ll even pose as employees of a legitimate company with a great job offer for you.

CyberSTAT: Employment scams tripled over the last three years, with 14 million victims losing $2 billion in 2022.

Avoiding Top Scams

These basic online behavior tips will help keep fraudsters away, no matter what tricks they have up their sleeves.

Create a family code word everyone can use to verify it’s really them on the phone and not an AI voice clone.

Create a family code word everyone can use to verify it’s really them on the phone and not an AI voice clone.

- Always verify who is contacting you no matter if it’s by email, phone, text, or other ways — especially if it’s someone you don’t know. Beware of scare tactics and anything needing you to act fast.

- Keep personal details to yourself. Never share your PII, including things like login data, financial information, birth date, or account numbers — no matter whom the asker claims to be. Never post your PII online because scammers troll social media looking for it.

- Always research businesses online before shopping, donating, or taking a job offer. Reviews and scam reports are helpful tools.

- Use online verification tools like MFA (multi-factor authentication) and fingerprint verification when available.

It’s a cybercrime jungle out there and everyone is a potential scam victim. Remember, common sense, vigilance and verification are some of the best tools we humans have to expose a scam for what it is, so don’t be afraid to use them.