Can Hackers Take A Bite Out Of Your Mobile Pay Solution?

August 17, 2024

With the many digital payment options available today, finding the most secure providers can be a challenge. The popularity of digital wallets has grown over time and writing checks and even using plastic cards for payments are quickly becoming the dinosaurs of our non-digital past. Mobile payment apps like Venmo (owned by PayPal) and PayPal itself are popular payment apps, but each have suffered their share of hacking problems. Many users now own mobile wallets and pay for goods and services with a quick tap of their phone. Using a mobile pay solution like Apple Pay, Google Pay, or Samsung Pay for those transactions may offer peace of mind knowing your payment data is safe and out of the reach of hackers.

Is Paying With A Smartphone Safe?

For those who wonder if mobile pay solutions are a safe way to go, many security experts believe they are actually safer than using a physical credit card. A card can be lost or stolen, and criminals can attach “skimmers” to payment stations and steal a card’s data with just a dip or a swipe. Mobile pay solutions remove those concerns with card-free transactions made with the touch of your device to a payment station. Mobile pay users also have the option of adding fingerprint or facial recognition, infusing even more layers of security to the transaction process.

How Does A Mobile Payment Solution Work?

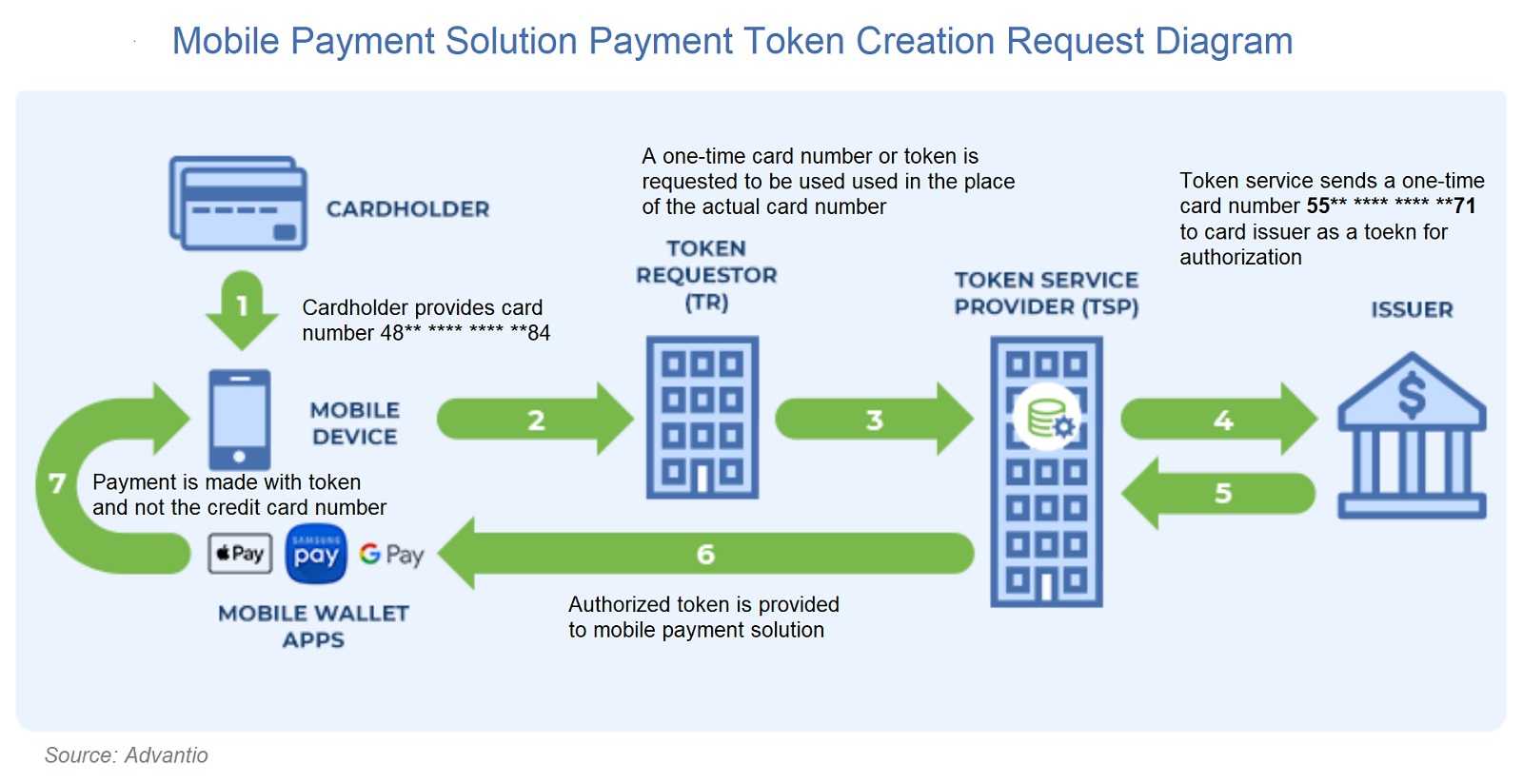

If you’re wondering how mobile payment works, you’re in good company. The main requirement is owning a smartphone of course. An iPhone for Apple Pay and an Android phone for Google Pay or Samsung Pay. Mobile pay solutions use encryption, a way of translating data to codes or symbols that can’t be understood if intercepted by bad actors. Encrypting data like credit card and bank account numbers, passwords and other data ensures the data is safe from hacking. Adding payment options is also safe since the details are encrypted and sent to mobile pay solution servers rather than being stored on a device. For a transaction, a service decrypts the data so your card’s payment network can be used, and then re-encrypts the data back onto the payment service server. Remember, mobile payment apps do not directly store your data, and that means there’s no data left to steal.

Additional Mobile Pay Security Options

- Mobile payment solutions allow users to choose a safe password for their device. Make sure it’s not easy to guess, including not using phone numbers or birth dates. If you write the password down, store it in a safe place separately from your mobile device or computer.

- Consider using extra security layers such as face or fingerprint recognition, since those attributes ensure only you are the user and can’t easily be duplicated.

- The “Find My Phone” feature locates a lost or stolen smartphone, allowing you to remotely disable the device, wipe your personal data and reset it to factory settings. Consider enabling it if you don’t already and plan to use a mobile payment solution.

Remember that nothing is 100% safe as a payment option, except perhaps cash, when completing an in-person transaction. But these new payment options provide a bit more security.