Is It Time to Freeze Your Credit? What to Know

February 5, 2025

With an abundance of scams and data breaches exposing our sensitive information, it doesn’t take much for a criminal to cobble together an identity profile and ruin a victim’s finances. That’s why more people every day are placing a credit freeze on their financial accounts. The question now is, should you?

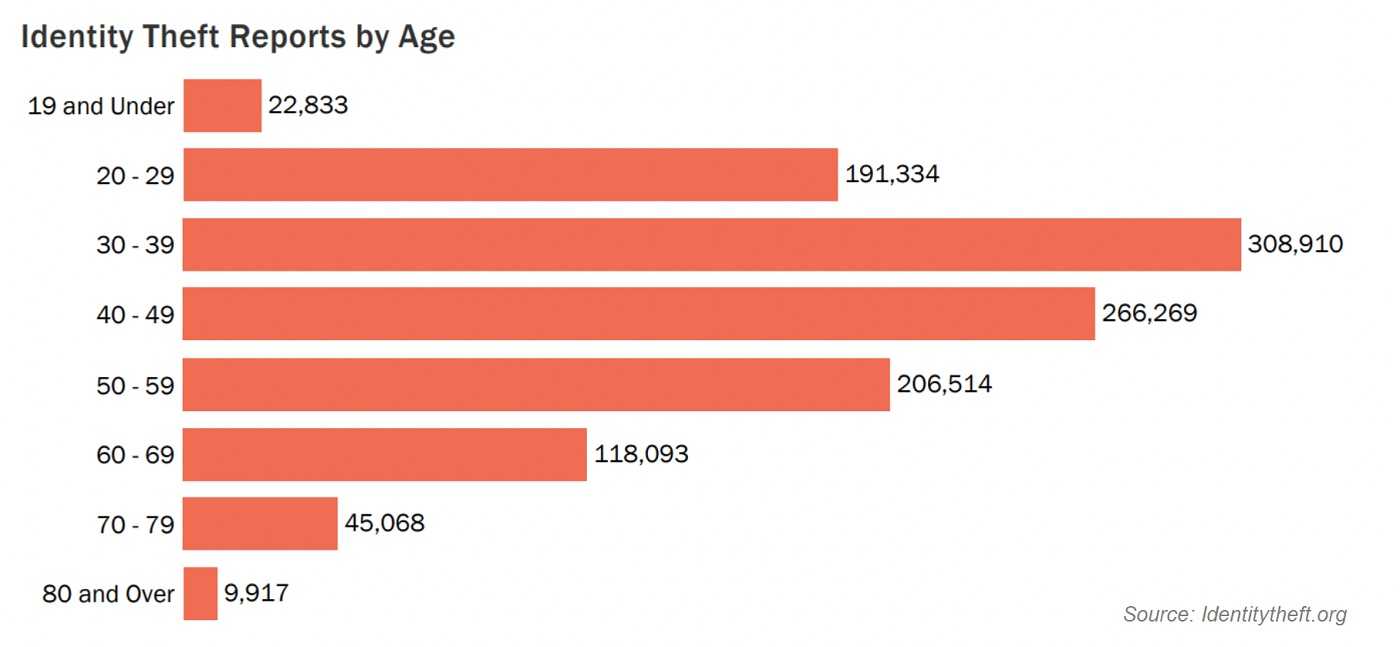

According to a study, identity fraud cost Americans $43 billion last year. An empty bank account, unexpected credit card purchases, and bills for accounts you never opened are signs something is wrong, so don’t wait to act.

Placing a credit freeze helps prevent new credit accounts being opened in your name. A credit freeze won’t prevent identity theft, but it can help soften the blow financially. One thing a credit freeze won’t do is excuse you from the responsibility of paying your bills. Sorry!

ABC’s Of A Credit Freeze

Applying a credit freeze is at no cost to you and is relatively easy to do. That’s especially true considering the herculean effort it takes to dig yourself out of a financial fraud attack and reestablish your credit.

You need to contact all three credit bureaus—Equifax, TransUnion, and Experian, individually. You can place a freeze over the phone or online. Just make sure you’re using the 100% legitimate contact information before moving forward. Once enacted, no one but you can open a new credit account, and you’ll need to temporarily lift the freeze to do so.

Lifting a credit freeze for any length of time means again contacting all three credit bureaus and is also free to do. Again, the time it takes to undo a credit freeze and reinstate it, is well worth the effort.

Our reasons to use a credit freeze or not is a choice best made by being informed. And since data breaches and scammers aren’t going away any time soon, regularly check your credit reports and limit the amount of personal information shared online. You’ll always be glad you did.