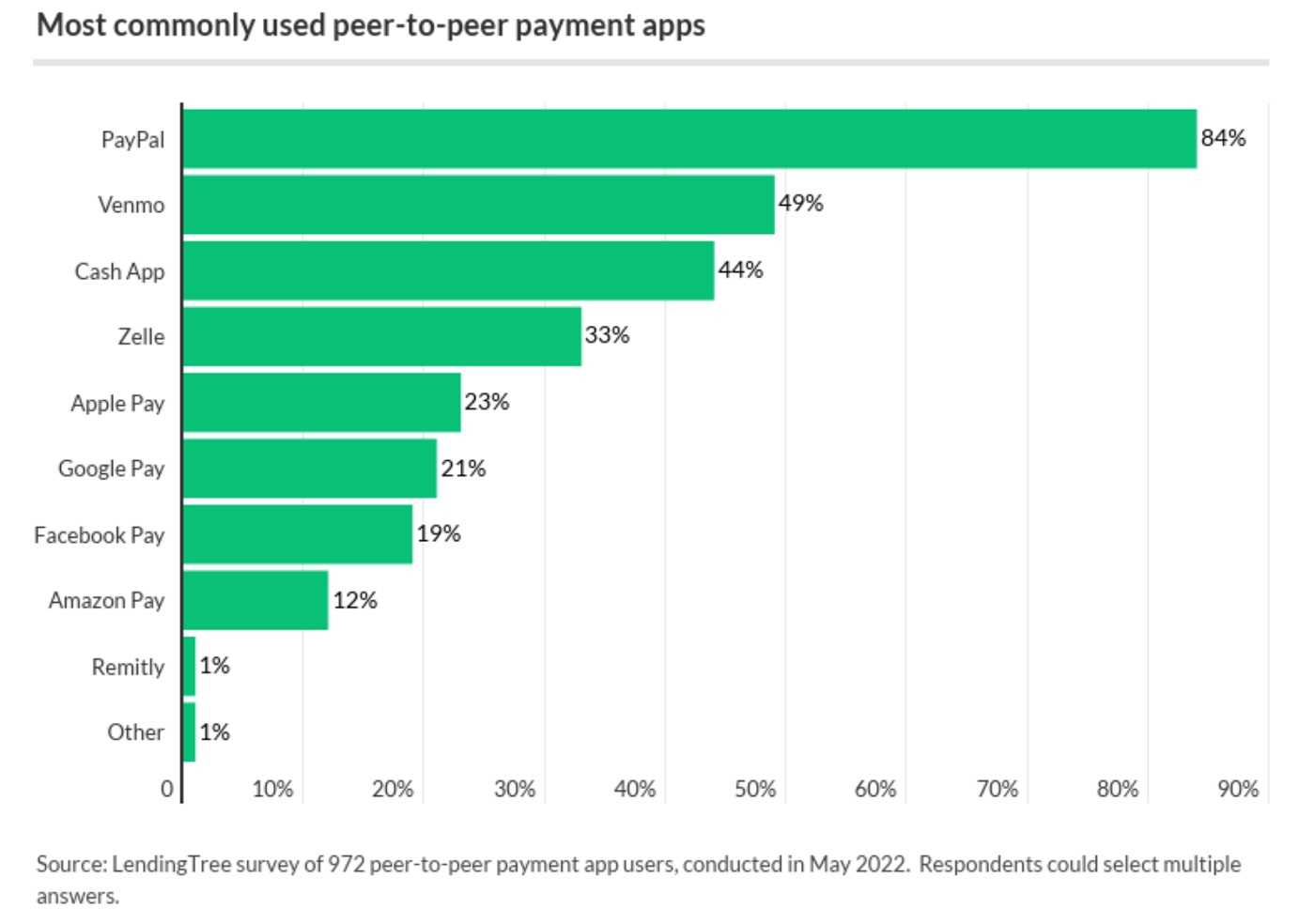

Most of us have heard of the various payment systems that allow us to pay almost anyone without writing the old-fashioned paper check. Now, we can pay nearly anyone, residing anywhere in the world with just a few taps on the keyboard or touch of an app. The three best known are PayPal, Venmo, and Zelle and all of them are increasingly being used for business purposes.

PayPal and Venmo work essentially the same way and are actually owned by the same company, though there are some small differences in how they are used. But that isn’t the focus of this article. We will discuss the security of the products. All of them are generally safe to use for personal or business reasons.

PayPal

PayPal allows the user to send payments to anyone in the world that has a PayPal account. For the most part, it’s free of charge. It allows quite a large amount of funds to be sent in a single transaction—up to $60,000. This means if you make a mistake, you can lose a big chunk of your money. However, there is a waiting period between when you send money and when it lands in the recipient’s bank. It gives the sender some time to cancel the transaction: No harm, no foul.

Venmo

Venmo is the payment service that allows you to avoid using words to make and receive payments. It furthers our society’s desire to stop talking altogether. You can let the recipient know why your sending money by using a cute emoji.

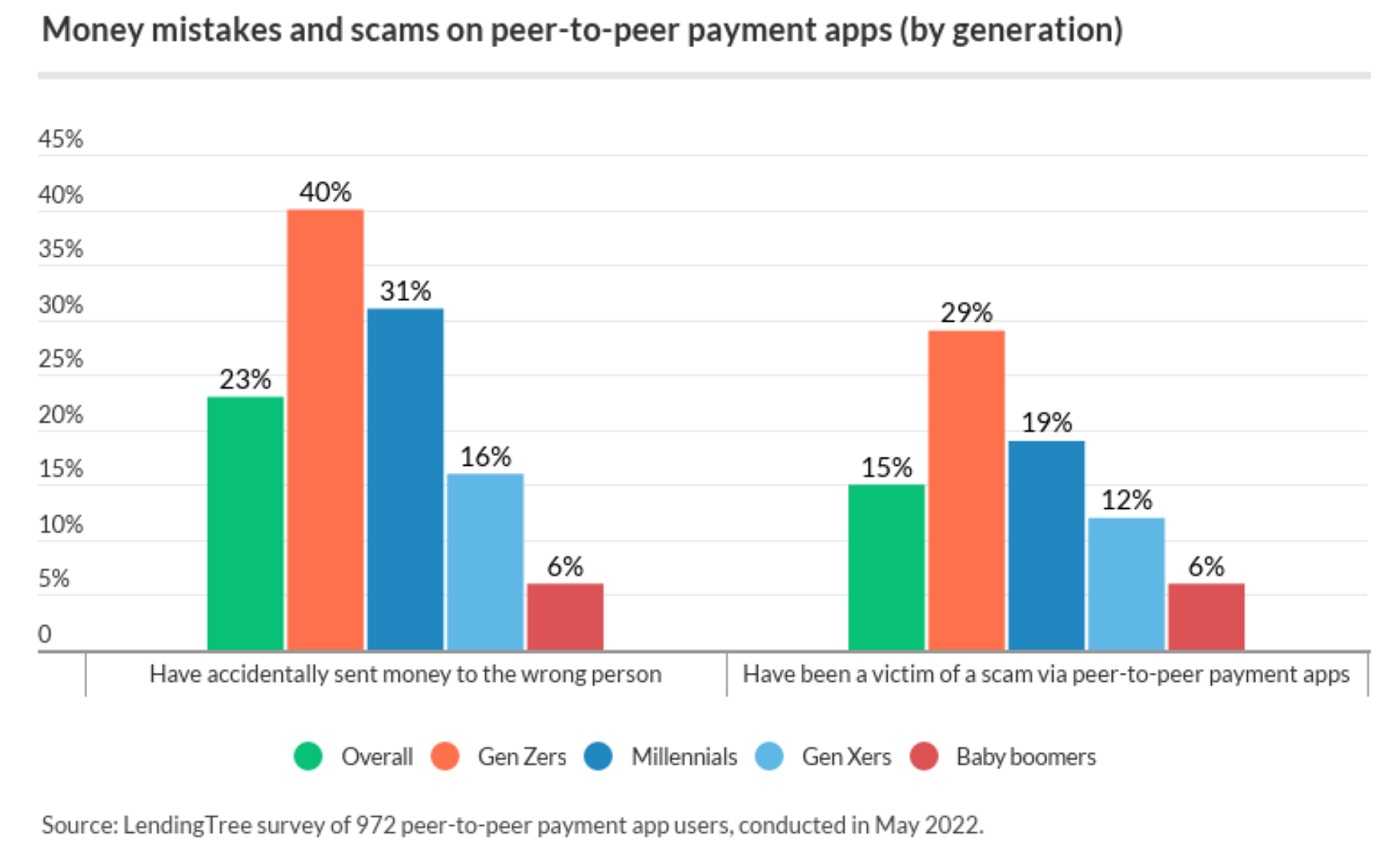

It can be treated somewhat as a “social” platform. It allows you and whomever you’re connected to, to see each other’s transactions. The risk is that anything that is lumped into the “social media” group is targeted more often by cybercriminals. Which means it is very important to stay on top of the latest scams!

With PayPal and Venmo, there may be a chance you can get your money back if you are the victim of fraud. However, it’s not guaranteed, and it certainly won't be quick.

Zelle

Zelle allows you to send money to nearly anyone with a U.S. banking account using an app or through the financial institution. It’s backed by hundreds of them and it is often available to you through their apps and website. This means that it uses the financial institution’s security infrastructure too, making it as safe to use as the financial institution’s website and app.

Like the others, it’s advised only perform transactions with those you know. Once you send the money, it’s gone. There is no recourse if you send money to someone and find out later that it was a scam. There is some protection if a transaction was not authorized, however.

But Are They Secure?

As for security, they are safe to use, with a few caveats, of course. They all provide encrypted transactions. On top of that, the Patriot Act actually requires financial institutions, which all of these services fall under, to verify a user’s identity. When someone signs up, they are asked for personal information such as social security number, name, address, passport numbers, etc. Some of them even require a photo of the user holding their photo ID card. While you can doubt this process is effective, it does act as a deterrent to cybercriminals. You see, if these services know the identity of each and every person using them, they are less likely to use them to commit crimes.

They all offer (or even require) using multifactor authentication (MFA) and it should be enabled. This means that if your user account and password are accessed by an unauthorized party, your information and financial accounts are safe because it’s not likely they will also have that MFA code.

Another important fact to remember is that these are essentially cash payments. When the money is sent, it is immediately gone from the account.

The Bottom Line

As with any online service or anything involving an account on the internet, if these services experience a data breach, well, you may be included in the list of users whose data gets compromised. Of course, everyone should be aware of attempted phishing accounts that ask for payments using any of these services. Be sure before you click “send.”

Generally, all of these services are as safe to use as any other service that provides an online portal or app. Just use common sense when using them. Follow these tips and you’ll limit your risk and can feel comfortable using this new, convenient technology:

Never share login information with anyone. Since these services are inked to a bank account and/or payment card, only you should know your login information.

Never share login information with anyone. Since these services are inked to a bank account and/or payment card, only you should know your login information.

- Use a strong passwords and unique credentials for each account. Your password should be unassociated with your personal details. Avoid using information such as your birthday, spouse’s or children’s names, social security number, etc. as your password or even as part of it. Always use different passwords for each online account or app.

- Don’t use other services to login to any account. It may be convenient to use your Google or Facebook account to log in to your other accounts, but don’t, especially for business accounts. If your credentials for those are accessed, so will be other accounts for which you use those same credentials.

- Set your accounts to be private. While it may be fun to see how others are spending their money, it’s not a great idea to share yours. By default, Venmo transactions are visible to anyone else using Venmo. Set yours to private. That will keep your transactions away from prying public eyes. If you have already used the app and had it set to public, you can go into your settings and change your past transactions to private too. Make sure all of these types of apps are set to the strongest security settings, using MFA all the time.

- Only interact with trusted users and businesses. While there are some safeguards if you fall victim to a scam or fraud, there is no guarantee you will get reimbursed. Only send money to people and businesses you trust.

- Delete contacts that you don’t know or don’t want to transact with. If you have someone in your contact list that you don’t want in there, delete it to avoid accidental transactions.

- Don’t keep large balances in your accounts. It's safer if you don’t keep large balances in your PayPal or Venmo accounts. Transfer it to your bank account. Your money is safer stored with your financial institution.