$10 Billion In Consumer Fraud Breaks Record

May 28, 2024

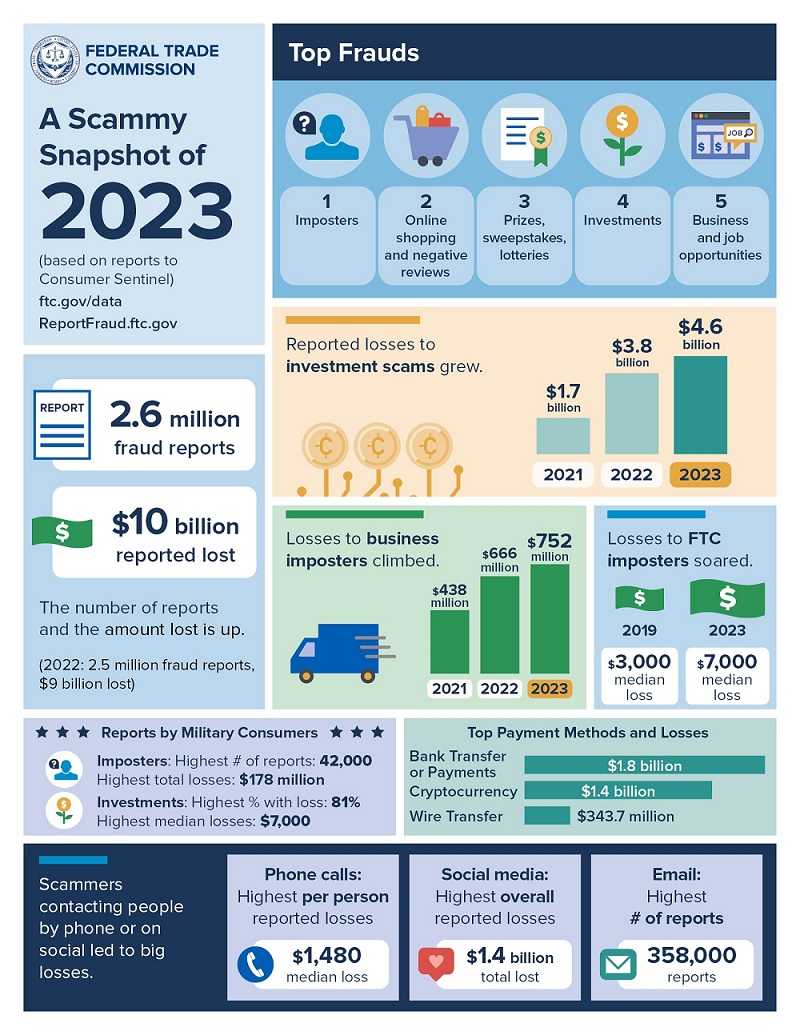

Breaking a record is usually seen as a good thing but this latest record-breaker is no reason to cheer. The FTC (Federal Trade Commission) released data from reported consumer fraud during 2023. The data shows U.S. consumers paid a record-breaking $10 billion price tag for fraud. That's a 14% jump over 2022, and that's not all.

Consumer's Pay Up, And Up

Let's face it, scammers are the only ones celebrating this $10 billion blunder. Just three years ago, the amount of money lost to fraud was $1.7 billion. Some of the top categories include investment scams, impostor scams, online shopping scams, and business and job opportunity scams. Below are some of the "highlights" contributing to the $10 billion price tag. Last year saw 2.6 million fraud reports, around the same number as 2022, but much more costly. Remember, these are only the reported crimes, but you can be sure the numbers are truly much higher.

Fraud Facts

- Investment Scams were number one with more than $4.6 billion lost to fraud, a 21% increase over 2022. Nearly 690,000 Americans reported losing money, while approximately $500 was the median amount lost per victim.

- Impostor Scams with bank transfers and cryptocurrency fraud at nearly $2.7 billion lost.

- Impostor Scams Breakdown

- Over 1 million reports of identity theft

- Fraudulent bank transfers and cryptocurrency were more costly than all other types of impostor scams combined. Also, there was a big uptick in business and government fraud, with business fraud totaling $752 million, up 72% over three years.

- Payment Fraud By Method: Bank transfers/payments at $1.8 billion, cryptocurrency at $1.4 billion, and wire transfers at $343.7 million.

- Means of scamming: The ways scammer's contacted victims by biggest loss is by phone, with median loss at $1,480 per person. Social media highest total loss at $1.4 billion, with the highest number of reports about email scams at 358,000, replacing texting as last year's favorite.

The Bigger Picture

A look at why scams are breaking records can't be done without acknowledging the lack of law enforcement to tackle every report of fraud, including those involving smaller amounts of money. As a result, scammers know they can limit their fraudulent acts to lesser amounts not likely to be investigated. What they lack in big money scores gets made up with a higher number of attacks.

Consumers Can Fight Back

What consumers can do to thwart fraud is stay aware of its red flags to stop fraud before it starts. Since emails and texts are most often used to scout potential victims, approach all with caution. Be on the lookout for phishing clues such as poor grammar and spelling, generic greetings, and unexpected links and attachments. These hold true for texts and email messages.

What consumers can do to thwart fraud is stay aware of its red flags to stop fraud before it starts. Since emails and texts are most often used to scout potential victims, approach all with caution. Be on the lookout for phishing clues such as poor grammar and spelling, generic greetings, and unexpected links and attachments. These hold true for texts and email messages.

Until better tools to combat fraud are available, a good dose of common sense does wonders in avoiding scammers.